Improving Mineral Exploration

Mineral exploration is far from easy, in fact, it is probably one of the hardest segments of the mining industry to participate in. The success rates are low, so low in fact, that for some mineral commodities (like gold) it is estimated that approximately 1 in 1,000 prospects ever becomes a commercially producing mine (at best). Those aren’t very good odds. Expanding that statistic out further, we estimate that out of 1,000 prospects for precious metals worldwide, only 5% or 50 make it to a level of advanced exploration (multiple drill rigs, infill drilling, etc.), only .05% or 5 make it to preliminary economic assessment (PEA) level, and only .03% or 3 make it to pre-feasibility level (PFS), with less than .02% or 2 achieving full feasibility study level. Within these two, one will become a producing mine within a span of approximately five years with the other having good odds of becoming a producing mine at some point in the future. The odds increase substantially once a level of advanced mineral exploration has been reached, from 1 in 1,000 to 1 in 10, but they are still low.

So where is the upside to mineral exploration?

Fortunately, not every prospect needs to become a producing mine to generate value for an exploration company. Value can be produced within the process of conducting mineral exploration, primarily through increasing the value of the prospect. With increasing knowledge and discovering deposits, comes greater project value and confidence. This project value can be capitalized on by the exploration company through increasing share price (if the company is public), or through the eventual sale or joint-venture partnership of the asset to a larger – or better capitalized – company.

For the few mines that do make it all the way through the exploration process to development and production, there can be a tremendous upside. According to Metals Focus, gold mining producers had their most profitable year ever in 2020 with an average profit per ounce of $828 after all-in sustaining costs (AISC). This is significantly higher than the previous record of $666 set in 2011.

While luck certainly can’t be ruled out as a key factor in many large mineral discoveries that have been made throughout the world, there are strategies that the most successful mineral exploration companies use to increase their odds of success.

The Mineral Exploration Pipeline

It is rare for a single company to take an exploration project all the way from prospect to production. Usually, these projects change hands through sale or partnership many different times before they are fully proven out. There are other cases, where projects get dropped entirely and then picked up repeatedly before they gain traction.

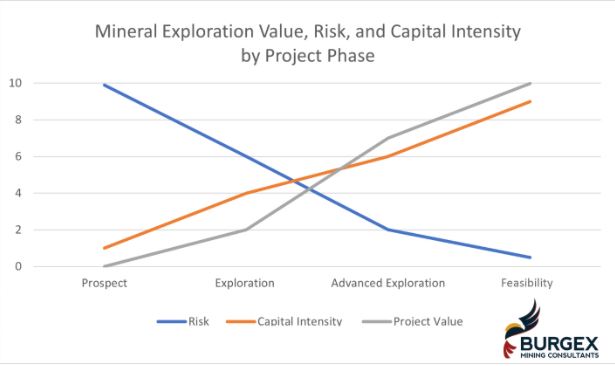

Mineral exploration professionals and companies tend to focus on a specific part of the exploration pipeline. From prospect generators who tend to operate in low capital intensity, high risk, and low project value environments, to groups that take advanced mineral exploration projects through feasibility. Those who conduct advanced exploration face high capital intensity, lower risk, and greater project value – project value that often comes with a higher barrier to entry. In the middle, there are mineral exploration companies that take projects from prospects through exploration or advanced exploration.

Understanding where your company fits into the pipeline is the first step to success. Identifying, on a broad scale, your risk tolerance, companies’ skillsets, and ability to raise capital for a project is key to understanding where to enter a project and what stage to target for an exit. The barriers to entry are low at the project generation and prospect phase but increase dramatically as a mineral exploration project reaches feasibility.

Leverage Your Team’s Experience

If you have a team that has lots of experience with project generation and prospecting, that’s probably what they are going to do best. If you have a team that is adept at advanced mineral exploration for disseminated gold deposits, that is the type of project you should focus on. Of course, there are lots of other factors to consider – like capital intensity – but focusing where your team is best suited will give leverage and increase your odds of success.

In general, prospect generators and early-stage exploration companies can adapt easily to working with a handful of different mineral commodities, while things get more specialized towards the later stages of exploration and development. By the time a project reaches the feasibility level, there will be many different experts involved – some of which are very highly specialized in different deposit styles and processing.

It is common to see smaller exploration mineral companies re-brand themselves to take advantage of market trends and ultimately, investor sentiment. There are currently many exploration companies exploring for battery and strategic metals in the US that were recently precious metals explorers. These shifts are easier for early-stage projects and become harder as resources are committed to advancing projects further down the pipeline.

Build a Deep or Broad Project Pipeline

Having a diverse portfolio is one of the cornerstones of investing. Having a diverse portfolio of mineral exploration projects is good for investors but isn’t always great for mineral exploration companies. Having a deep project pipeline, on the other hand, can be a great strategy. Once you have found your segment of the exploration pipeline that works, focus on generating pipeline depth or breadth.

Pipeline depth and breadth mean different things to different-sized exploration companies. To a prospect generator, pipeline breadth may mean having 10 different prospects spanning a handful of commodities. The objective of most of these generators is to partner with bigger companies to advance each project, which allows them to have more diversity as the more advanced work will be tackled ideally by a more specialized team. For a junior exploration company focused on early-stage mineral exploration, pipeline depth means having a few projects of a similar theme – either by commodity or deposit style. This is a great way to distribute risk and maintain momentum when project hiccups are encountered. For more advanced explorers, pipeline depth is characterized by having projects of a similar theme that are in various stages of exploration. Advanced explorers may have one project approaching PEA, another working toward PFS, and three that are still being explored in the early or advanced stages. As projects are de-risked and value becomes inherent, the pipeline can be sold off to fund the advancement of core assets.

Have an Exit Strategy

As with any business, the value of having an exit strategy in mind from the beginning of a venture is apparent. This exit strategy will determine key decisions and help place your company in a position to succeed. For prospect generators, this strategy usually involves selling off a certain number of projects a year. For explorers through advanced explorers, the exit strategy is usually selling a project to a larger company. For the very advanced explorers, who are working through the stages of feasibility, the exit strategy may involve being acquired by a major miner or bringing the asset into production. Regardless of what the exit strategy is, having a clear goal in mind will prevent drift in strategy and priority – it also provides clear intent for investors and other stakeholders.

Patience Patience Patience

As most in the mineral exploration industry know all too well, you can’t have too much patience. It is not uncommon to work on a mineral exploration project for a decade or more – with many years-long periods of little to no advancement. As a rule of thumb, permitting – even for exploration – is only likely to get more difficult over time. Many projects get held up when it comes to retaining a drilling contractor, finding staff to run the program, and even assaying has recently taken longer to complete.

There are ‘quick flips’ that happen when the timing is right and the markets are hot, but generally, it’s going to take a long time to advance a mineral exploration project. Understanding this upfront will help with making planning decisions and setting realistic expectations for investors and potential partners.

Burgex mining consultants have over a decade of company experience and over 100 years of combined experience in mineral exploration for commodities ranging from industrial sands to precious metals. We understand the process and can help you advance your project from claim staking through feasibility studies. Let us leverage our expertise to help you succeed in mineral exploration!