Mineral exploration is the process of searching for evidence of mineralization hosted in the surrounding rocks. The general principle works by extracting pieces of geological information from several places and extrapolating this over the larger area to develop a geological picture. Exploration works in stages of increasing sophistication, with cheap, cruder methods implemented at the start, and if the resultant information is economically interesting, this warrants the next, more advanced, and expensive techniques. However, it is rare to find sufficiently enriched ore bodies, so most exploration campaigns stop after the first couple of stages.

Broadly speaking, the stages of exploration are as follows:

- Prospecting – desktop study and the physical searching for a mineral deposit in the field

- Geological, geochemical, and geophysical surveys – searching and evaluating a deposit on the surface

- Drilling – evaluating a deposit below the surface

- Resource estimates – calculating a grade and tonnage

- Pre-feasibility studies (PFS) – preliminary mine planning and economic analysis

Risk Deduction

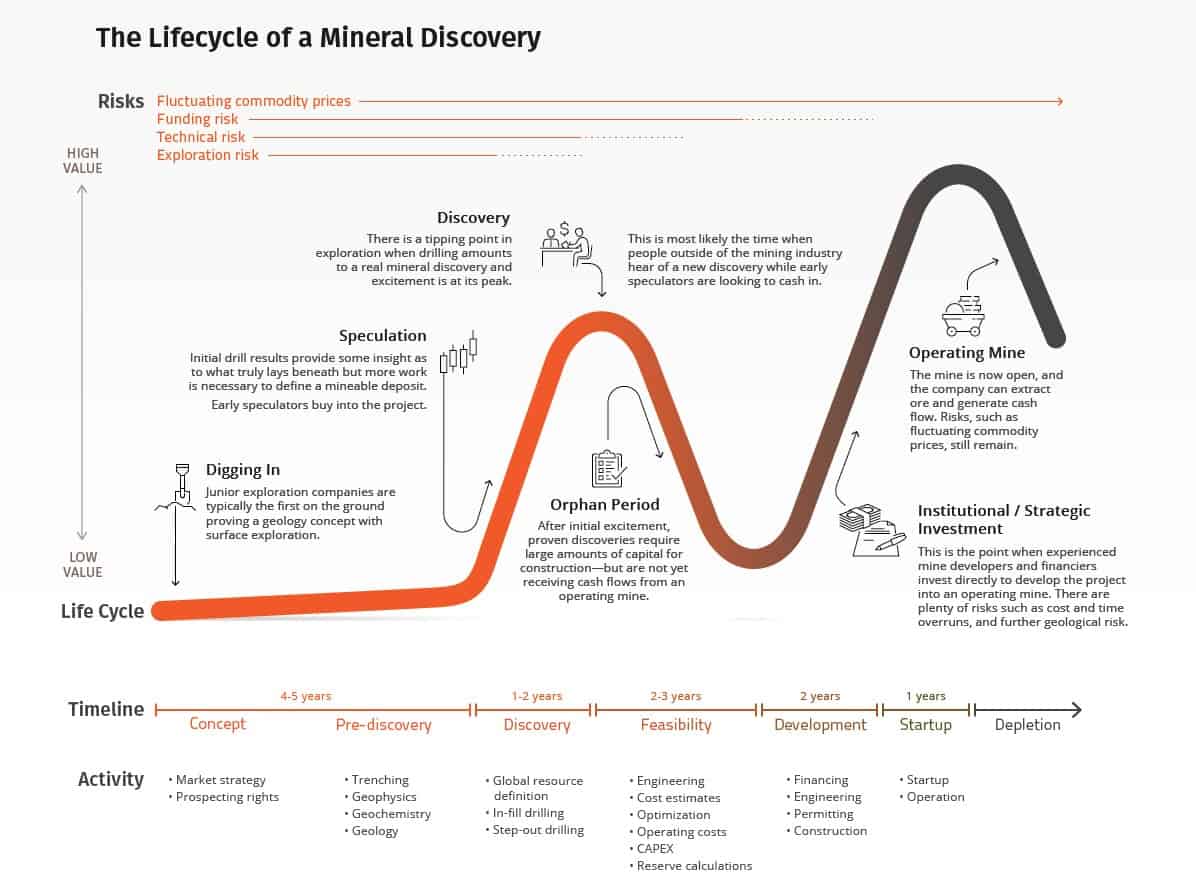

Since mineral deposits are rare, finding one is challenging. The odds of success of any exploration program are relatively low. Moreover, it has been estimated that the odds of a small mineral showing discovered by a prospector becoming a mine are on the order of 1 in 1,000,000 or more (recognizing that a prospector may discover many small showings in the course of a field season). Even when a mineral deposit has been defined, the odds of it becoming an operating mine are, at best, 1 in 1,000. With these odds it becomes imperative to understand the main sources of risk, and how to best mitigate exploration risk. Exploration risk, also called assay risk, because the assay results remain the final verdict on whether or not a significant deposit exists. When risk allows mitigation, the probability of exploration success increases.

Address risk deduction in three fundamental ways:

- Increasing the number of prospects for examination

- Increasing success probabilities

- Changing success probabilities per test by learning

Increasing Number of Prospects

As mineral exploration is a capital-intensive process, a significant advantage belongs to large firms. In addition, these firms have the financial resources to acquire prospects from smaller companies or from internal prospect generation. Moreover, joint venturing, where exploration expenses, responsibilities, and benefits remain shared among companies, is the most usual way to increase the number of prospects for examination.

Increasing Success Probabilities

Risk Reduction Among Deposit Types

Many exploration companies commonly use an economic filter, such as net present value, made operational by requiring the discovery of a minimum-size deposit. Identification of minimum-size deposits remain addressed by recognizing and using the significant differences in grades and tonnages among different mineral deposit types. If the goal is discovering a world-class gold deposit (in the upper 10% of all deposits in terms of contained metal), porphyry copper-gold or sediment-hosted gold deposits require fewer examinations than Comstock epithermal vein deposits types.

On average, having a 95% chance of discovering a +3-million-ounce gold deposit, 50 low sulfide quartz Au vein deposits would need examination, 26 epithermal Au or hot-spring Au deposits, 16 sediment-hosted gold deposits, or 11 porphyry Cu-Au deposits would need to be examined.

To further delineate the relationship between deposit styles and world-class potential for gold, copper, and zinc:

- About 35% of known porphyry copper-gold deposits contain enough gold to be considered world-class

- Roughly around 25% of known porphyry copper deposits have enough copper to be considered world-class

- About 30% of known sedimentary-exhalative zinc-lead deposits have enough zinc to be considered world-class

Risk Reduction from Political and Security Sources

Furthermore, operating in politically unstable jurisdictions opens an exploration program to the risks of losing permitting and asset expropriation. Among ways to reduce political or security risk are to involve investors who are unlikely to be expropriated or to avoid countries where the risk is high. In addition, the Fraser Institute publishes an annual survey of mining companies, ranking investment attractiveness of governmental jurisdictions worldwide.

Changing Success Probabilities Per Test by Learning

In addition, there is a form of learning where understanding of the geology and deposit model might be modified as exploration progresses. This form of learning can have a profound effect on reducing risk in exploration. When poorly applied, it leads to complete failure. Also, the key to the successful application of this form of risk reduction is the nature of the exploration. Organizational culture needs to encourage learning and willingness to reject present models if warranted and yet maintain focus. There are many organizational traits that adversely affect profits in exploration firms. Many involve risk aversion behavior that discourages the kind of learning that can most significantly reduce exploration risk.

Burgex Mining Consultants has the experience necessary to help mineral exploration companies navigate and mitigate exploration risk. Burgex employs industry best practices in performing risk assessment for exploration projects. It has successfully guided clients from prospecting through feasibility. Contact Burgex today for a risk assessment for your exploration program.