Geographical information systems (or GIS) are revolutionizing how the modern world visualizes, consumes, and uses market information, especially for mineral market analysis studies. Not all markets are entirely geographically based, but virtually all of them have some sort of geographic tie. Video streaming services, for example, can be utilized anywhere in the world with internet access and a VPN perhaps – but determining locations for best serving those markets with infrastructure is very geographically based. There are few businesses that would not benefit from some sort of market study.

Mineral Market Analysis in Mining

Within the mining industry, transportation logistics and costs (as well as environmental, regulatory, labor access, and utility factors) weigh heavily on every operation worldwide. The viability of these operations hinges on the economic interplay of the factors mentioned above. Within the construction aggregate industry specifically, transportation logistics are critical.

Mineral Market Analysis for Construction Aggregates

Transportation or other construction projects are generally going to utilize the nearest available aggregate product in spec. It is not uncommon for transportation costs to exceed the purchase price of the material itself. Therefore it makes the most economic sense for a contractor to buy from the nearest quarry or pit to produce the needed aggregate. In many parts of the world, it is possible to locate quarries and pits near consuming populations, but in other cases, they have been found hundreds of miles away and will need to be transported. Aggregate producers will build yards and facilities for distribution closer to high-demand regions. In any case, planning for quarry placement extends far beyond just finding a suitable geological unit with available land for development. The placement of these quarries begins with conducting a mineral market analysis study.

Traditional Mineral Market Analysis

Traditional market research for minerals and other consumables relies on tabulating estimated supply and demand based on knowns, projections, and assumptions. Populations are calculated based on census reports by incorporated area, census tract, or county. This population is multiplied by the estimated consumption of the product over a designated time (day, month, year) to generate an estimated demand. For construction aggregates, demand is generally calculated by tons (or tonnes) per capita annually within a designated region. Supply is estimated simply by adding up anticipated production (or distribution) within the same area. The formula calculates supply and demand on an individual site basis – generally within a spreadsheet. Depending on the complexity of the market is analyzed, this can take anywhere from days to weeks. A typical mineral market analysis for a greenfield site may take several weeks and may require on-the-ground intelligence to determine accurate supply and demand.

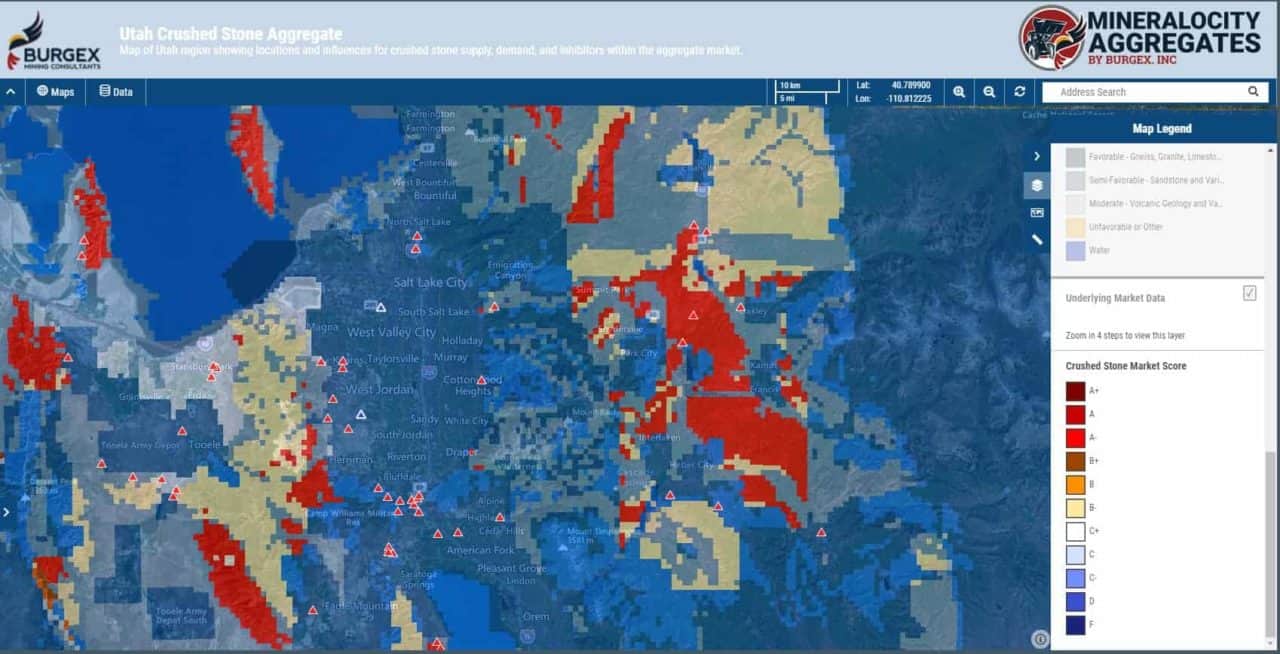

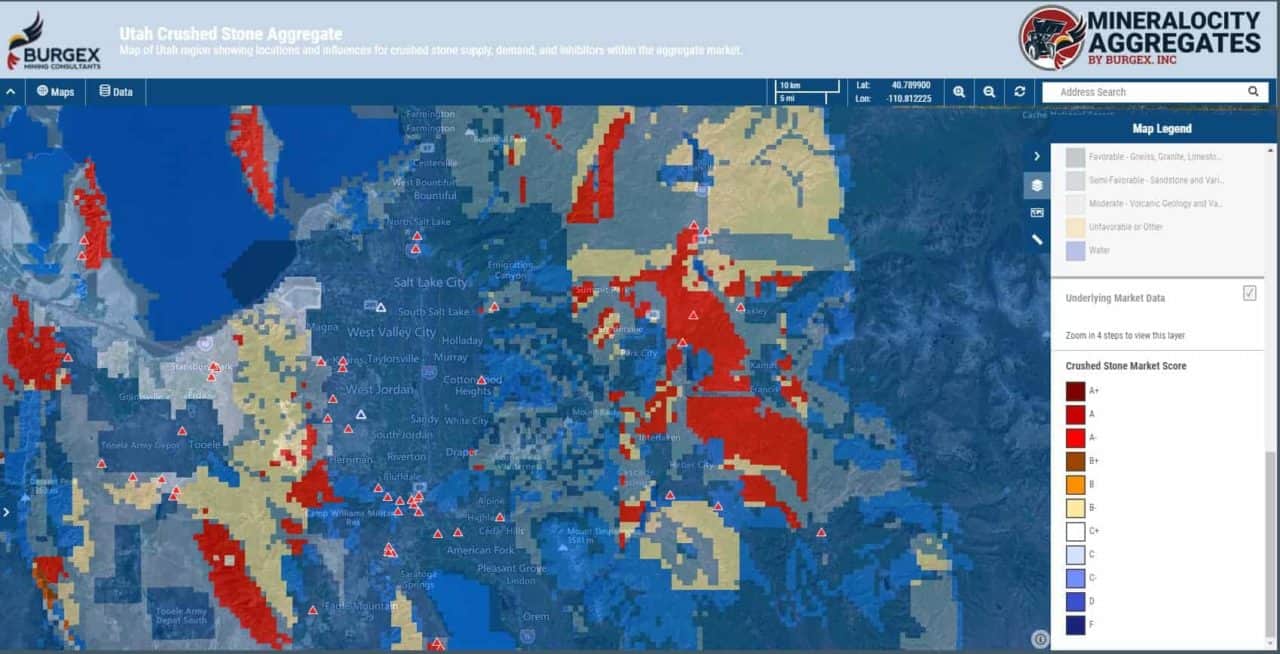

The Mineralocity Aggregates Revolution

With the advanced GIS tools utilized by Mineralocity Aggregates, dynamic versions of these same calculations are run on a matrix of granular grids of less than one square mile that cover entire states and regions. This generates a high-resolution interactive layer that can be used to identify areas of supply deficit – areas that could be ideal for the placement of a new quarry, pit, or distribution yard. Not only can areas of deficit be identified quickly on a regional or statewide basis, but the platform provides a host of other interactive data layers – such as the estimated annual production of existing commercial quarries, favorable geological units that currently host the significant output of construction aggregates, and regional economic and population growth indicators for future planning and projections.

The Mineralocity Aggregates platform will generate weeks or even months’ worth of actionable mineral market analysis research within hours. It is anticipated that this platform will find vital use with local, regional, and national construction aggregate producers to analyze current operations, select greenfield sites, and develop long-term plans for growth. The platform will also be helpful for those who supply the aggregate industry, contractors who regularly purchase construction aggregates, and researchers, both governmental and private, who wish to understand infrastructure construction and growth trends on an intimate national scale.

Burgex plans to continue developing the Mineralocity Aggregates platform to further enhance mineral market analysis through the dynamic study of transportation vectors, pricing, and demand growth projections of up to fifty years. Contact us today to learn more and register for updates before the anticipated platform release in the spring of 2022. In addition to Mineralocity Aggregates, Burgex has advanced capabilities to conduct mineral market analysis studies for a wide range of mineral commodities.